FXWM

Forex News, Updates and Trade Information

Wednesday 19 July 2017

Tuesday 20 June 2017

Technical Analysis: Chart Patterns - Double Tops and Bottoms

Double Tops and

Bottoms

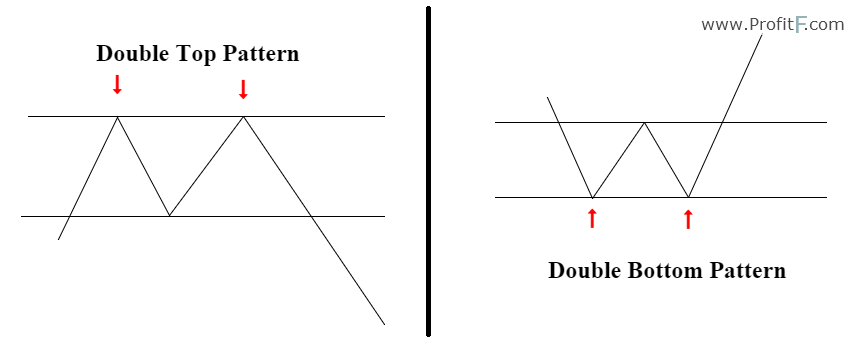

The Double Top or Double Bottom pattern

are both easy to recognize and one of the most reliable chart patterns, making

them a favorite for many technically-orientated traders. The pattern is formed

after a sustained trend when a price tests the same support or resistance level

twice without a breakthrough. The pattern signals the start of a trend reversal

over the intermediate- or long-term.

Technical Analysis: Chart Patterns - Cup and Handle

Cup and Handle

The Cup and Handle is a bullish continuation pattern where an upward trend has paused, but will continue when the pattern is confirmed. The ‘cup’ portion of the pattern should be a “U” shape that resembles the rounding of a bowl rather than a “V” shape with equal highs on both sides of the cup. The ‘handle’ forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Once the handle is complete, the stock may breakout to new highs and resume its trend higher.

Technical Analysis: Chart Patterns - Head and Shoulders

Technical Analysis: Chart Patterns

Head and Shoulders

The Head and

Shoulders is a reversal chart pattern that indicates a likely

reversal of the trend once it’s completed. A Head and Shoulder Top is

characterized by three peaks with the middle peak being the highest peak (head)

and the two others being lower and roughly equal (shoulders). The lows between

these peaks are connected with a trend line (neckline) that

represents the key support level to watch for a breakdown and trend reversal. A

Head and Shoulder Bottom – or Inverse Head and

Shoulders – is simply the inverse of the Head and Shoulders Top

with the neckline being a resistance level to watch for a breakout higher.

Subscribe to:

Posts (Atom)